FAQs for Tourism Businesses and Consumers

Please note the following FAQs are subject to changes and may be updated from time to time.

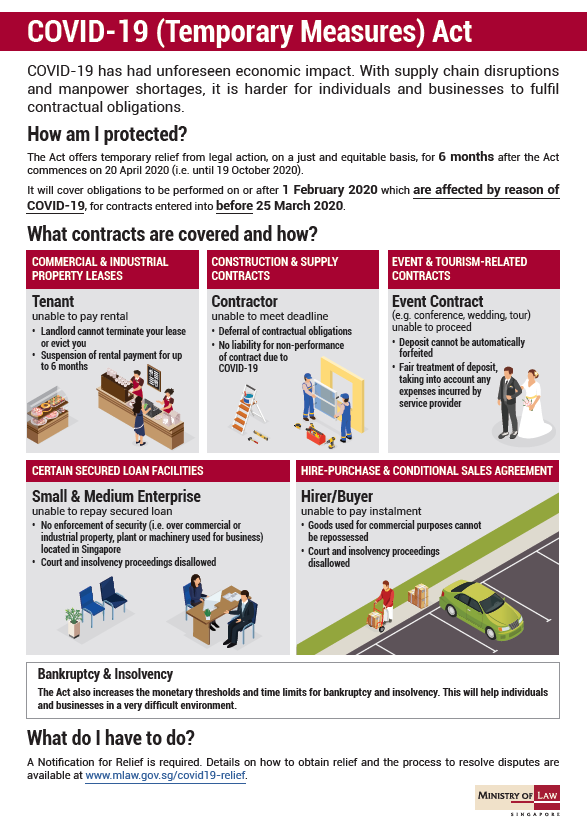

1. What is the Act about? Who benefits?

COVID-19 has had impact on contracts relating to commercial undertakings (e.g. construction projects), non-residential tenancies and individual consumer transactions (e.g. bookings for events). In many cases, this has undermined the ability of individuals and businesses (including within the tourism industry) to fulfil contractual obligations. It would be unfair to hold them strictly liable for their failure to do so.

Amongst other things, the Act aims to provide temporary and targeted protection for businesses and individuals who are unable to fulfil certain contractual obligations because of COVID-19. It seeks to provide temporary cash-flow relief for these businesses and individuals, who may otherwise have to pay damages or risk having their deposits or assets forfeited.

The measures do not absolve or remove contractual obligations, but only suspends those obligations for an initial period of six months.

This gives these businesses and individuals time to work out a solution with the other party without the threat or uncertainty of litigation or legal proceedings.

2. What type of contracts are covered?

The Act covers the following contracts, as long as they were entered into before 25 March 2020:

(1) Leases or licences for commercial or industrial property (e.g. lease for retail space or restaurant)

(2) Construction contracts or supply contracts (e.g. contract for supply of materials)

(3) Event contracts: provision of goods and services for events (e.g. venue or catering for weddings, MICE event)

(4) Tourism-related contracts: provision of goods and services relating to tourism (e.g. cruises, hotel accommodation bookings)

(5) Certain secured loan facilities granted by a bank or finance company to Small & Medium Enterprises (SMEs)

(6) Certain hire-purchase agreements (e.g. where the good hired is a commercial vehicle)

3. What relief does the Act provide? How will the measures protect me or my company?

The Act aims to provide temporary relief from legal action for up to six months after the Act commences on 20 April 2020 (i.e. until 19 October 2020). The Act applies only to those contractual obligations to be performed on or after 1 February 2020 that cannot be fulfilled because of COVID-19, for contracts entered into before 25 March 2020.

When a party to a contract serves a notification for relief on the other party, the following actions will be prohibited:

(a) Starting or continuing court proceedings or insolvency proceedings.

(b) Enforcing collateral over immovable property (e.g. commercial premises).

(c) Enforcing collateral over plant or machinery that is used for business (e.g. delivery vehicle).

(d) Terminating leases for commercial or industrial property or licence of non-residential premises.

If any court proceedings have already started, they will be stayed or suspended.

Additional relief applies for the following contracts:

(1) Event and tourism-related contracts:

(a) Deposits cannot be automatically forfeited. Instead, an Assessor will determine whether it is just and equitable in the circumstances of the case for the deposit or any part of the deposit to be forfeited.

(b) Where applicable, deposits that have already been forfeited will be restored.

(c) This does not mean deposits are automatically refunded to the consumer.

(2) Construction and supply contracts:

(a) Contractors will not be liable for breach of contract or liquidated damages.

(b) Calling on a performance bond will not be allowed.

For an overview of the Act, please see the Ministry of Law infographic at Annex A.

4. Where do I get more information?

Please visit the Ministry of Law’s website, www.mlaw.gov.sg/covid19-relief, for more information.

Annex A

Updated as of 23 April 2020