To help Singaporeans and businesses tide through the challenges from the heightened safe distancing measures, the Government has unveiled a Solidarity Budget on 6 April 2020 – over and above the $55 billion COVID-related measures under the Unity and Resilience Budgets introduced in February and March.

As part of the Solidarity Budget, tourism businesses will receive the following to help them cope.

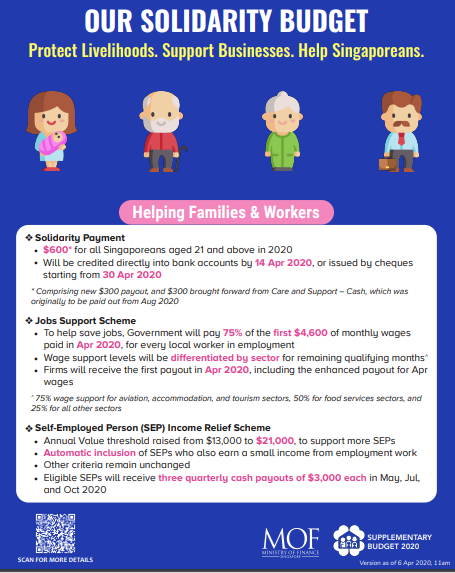

1. SUPPORTING WORKERS, PROTECTING LIVELIHOODS

- [Enhanced] Job Support Scheme (JSS)

With the extension of the circuit breaker period till 1 June 2020, the Government will provide 75% wage support on the first $4,600 of gross monthly wages for local employees across all sectors for the months of April and May 2020. The first JSS payout will be in April 2020 and the enhanced payout for May 2020 will be disbursed by end-May 2020.

The Government will extend the Jobs Support Scheme payout, to cover wages of employees of a company who are also shareholders and directors of the company (shareholder-directors). This support will only apply to companies that were registered on or before 20 April 2020, and for the wages of shareholder-directors with Assessable Income of $100,000 or less for Year of Assessment 2019. The May 2020 and subsequent JSS payouts will include support for qualifying shareholder-directors.

- [Enhanced] Expanded criteria for Self-Employed Person (SEP) Income Relief Scheme (SIRS)

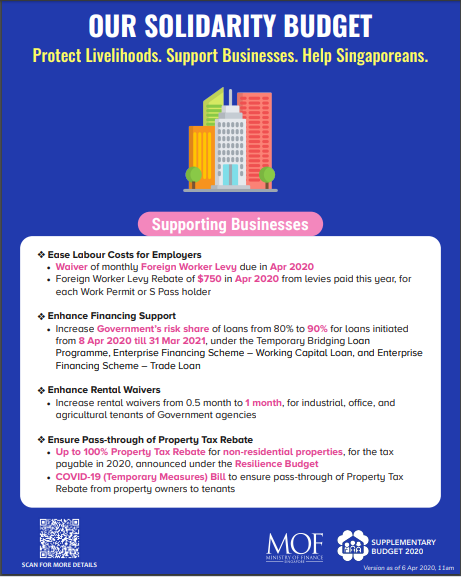

- [New] Waiver of monthly Foreign Worker Levy (FWL)

The monthly Foreign Worker Levy (FWL) due in April and May 2020 will be waived.

- [New] Foreign Worker Levy Rebate

Businesses will get a Foreign Worker Levy Rebate of $750 in April and May 2020 from levies paid this year, for each Work Permit or S Pass holder.

2. SUPPORTING BUSINESSES

- [Enhanced] Rental waiver for industrial, office and agriculture tenants of Government agencies

Office, commercial and agriculture tenants of Government agencies will get a 1-month rental waiver.

- [New] Bill to ensure property owners pass on Property Tax Rebate for 2020 in full to tenants

The COVID-19 (Temporary Measures) Bill will ensure pass-through of Property Tax Rebate from property owners to tenants. More details here.

3. ENHANCING FINANCING SCHEMES

- Increase in the Government’s risk share of loans

The Government’s risk share of loans will be increased from 80% to 90% for the Enterprise Financing Scheme-Trade Loan, Enterprise Financing Scheme-SME Working Capital Loan, and Temporary Bridging Loan Programme. This applies to loans initiated from 8 April 2020 till 31 March 2021.

AT A GLANCE